BMW’s R1250GS still dominates the sales charts – and the new R1300GS is likely to do the same

The Status of UK Motorcycling - Spring 2024

As the days start to get longer and endless torrents of rain wash the remains of the winter salt from the roads we’re fast heading into the new biking season – with riding, racing and new bike purchases starting to come to the fronts of our minds. But what is the state of play for motorcycling in the UK right now? We’ve dug into the data to find out the key trends.

New bike sales decline

The final numbers for 2023 showed that when it comes to buying new bikes there was a decline compared to the previous year. That’s not a huge surprise. After all, barely a day has gone by since Liz Truss’s catastrophic ‘mini budget’ in September 2022 without headlines about high interest rates and rising bills, all in the face of a cost-of-living crisis that’s been ongoing since 2021. The chances are that you don’t feel better off now than you did a couple of years ago.

Whenever budgets start to get squeezed non-essential purchases get postponed and for a large proportion of British riders, erring on the ‘leisure’ side of motorcycling, that means a brand-new bike can wait. The totals for last year showed that the overall bike market in this country was down by a modest 2.5%, dropping from 116,534 sales in 2022 to 113,589 in 2023. But those numbers warrant some further dissection as there have been much more substantial shifts when it comes to particular classes and categories.

The biggest losers of the year were scooters and the retro-style machines that the MCIA defines as ‘Modern Classic’ bikes. Sales of the former dropped by 2322 to 24,577, amounting to an 8.6% decline. Various factors are likely to be behind that decrease, notably the financial squeeze that many buyers are feeling but also the encroachment of the fast-growing e-bicycle market. Those same e-bikes are also behind the almost complete annihilation of the 50cc moped market over the last few years – and in 2023 it dropped another 22.8% to just 5,553 new registrations. After all, why buy a bike that needs insurance and tax if you can get away with an electric-assisted pedal bike that does nearly the same job without any of those overheads?

Although there was a double-digit decline in the touring bike market, down 12.3%, it was already at a low level so the actual numbers only slipped from 2942 registrations in 2022 to 2580 in 2023. The unstoppable rise of the adventure bike, many of which are used purely as tourers, is the reason for that. But the slowdown in the ‘Modern Classic’ arena, with sales dropping by a substantial 1179 from 12,117 to 10,938, could be a sign that tastes are moving away from 1960s-inspired machines after several years of sustained growth in that segment.

Turning to the climbers in the charts, adventure bikes are still rising and 2023 saw further increases so they now account for nearly 19% of all new registrations. But the rate of growth is dropping – in 2021 the adventure bike market grew by 19.6%, in 2022 it grew 4.8%, and in 2023 the increase was 1.9%. Are we reaching saturation point? Possibly, as other segments saw bigger increases both in percentage terms and actual sales. Naked bikes, for instance, grew 5.5%, extending their lead over adventure models and, with a 22% market share, remaining the most popular category overall. So called ‘Competition’ bikes – meaning road-legal enduro, trials and trail models saw a 7.1% rise and, while still a small segment compared to adventure machines, that figure amounted to a growth of 409 sales (up from 5780 to 6189), while adventure bike sales rose by only 401 registrations.

Even sports bikes, in decline for many years since their days as the dominant lifeform in UK motorcycling, are having a resurgence, with 2023 marking the second consecutive year of growth, up 3.9%, following a 7% increase in 2022.

Superbike sales aren’t all bad news – BMW’s S1000RR has done a roaring trade

Which are the most popular new bikes?

The official DfT statistics for vehicle licensing lag a bit behind the MCIA’s sales figures but we can look to the numbers for the first three quarters of 2023 to get a clear picture of which models are hits and which are misses in the current climate.

It’s no surprise to see BMW’s R1250GS Adventure and R1250GS near the top, and when combined the total registrations come within a whisker of matching the best-selling model on the Government’s list, the Yamaha Nmax 125 scooter.

But below the BMW GS, the best-sellers list shows a remarkably mixed-up combination of makes, models and styles. If we only look at bikes over 125cc, during the first three quarters of last year, the next best-seller was Honda’s CB750 Hornet – showing that its combination of an attractive RRP and high levels of performance and equipment compared to rivals is just as successful as it appears on paper. But it’s followed by Royal Enfield’s HNTR 350, then Triumph’s Street Triple RS and Kawasaki’s Ninja 1000 SX. Each a very different bike, illustrating the diversity of the market at the moment.

Even if ‘Modern Classic’ bikes are on the decline, it doesn’t seem to be harming Royal Enfield. If we look only at bikes over 125cc, RE has three models in the top ten best-sellers, with the Meteor 650 and Classic 350 joining the HNTR 350, and the Interceptor 650 and Meteor 350 aren’t far away either. The BSA Gold Star, too, has shown itself to be a surprise hit, with 600 registered in the first three quarters of the year. That’s enough to pip some strong-selling machines including the Triumph Tiger 660 Sport (595 registrations), Honda CB500X (562) and even Yamaha’s MT-07 (529 sales during the first three quarters).

When it comes to that resurgent sports bike market, there’s a distinct split between the high-end machines and the more affordable offerings. At the 200hp-plus end of the market, BMW is again a winner, with the S1000RR achieving 551 sales in the first three quarters of 2023 and another 70 customers snapping up the exotic M1000RR. That means BMW’s superbike is its second best-seller after the R1250GS and gives lie to the old adage of ‘win on Sunday, sell on Monday’ as the S1000RR/M1000RR’s WSBK record isn’t littered with victories.

The bike that dominated superbike racing in 2023 was Ducati’s Panigale V4, and its sales illustrate that there’s still a large segment of customers for whom the term ‘cost-of-living crisis’ is something that only applies to other people. In total, Ducati registered 230 Panigale V4s in the first three quarters of 2023, but remarkably nearly half of them – 97 – were the £38,995 Panigale V4 R. That homologation special outsold the V4 S (52), the V4 SP2 (39) and left the base Panigale V4 to bring up the rear on 38 registrations during that period. However, Panigale sales were dwarfed by those of the Multistrada V4, which accounted for 562 registrations (all variants) over the same nine months. So much for Ducati being a V-twin sports bike company (its best-selling twin was the Desert X on 199 registrations, while 160 people bought the Panigale V2, which sticks to the classic Ducati recipe).

Other litre superbikes lag behind those rivals in terms of sales, but Yamaha’s R1 appears to have come out on top from the Japanese crop in terms of registrations in what might be its final full year on the market here as the company isn’t planning to update it for the latest ‘Euro5+’ emissions rules.

However, it’s at the other end of the sports bike market that there’s substantial activity at the moment. We’ve just seen Suzuki launch the GSX-8R and Triumph introduce the Daytona 660, and there are rumblings that Honda has a CBR750 based on the CB750 Hornet waiting in the wings. Those launches indicate an appetite from customers for a breed of daily-useable sports all-rounders in the mould of the old Honda CBR600F of the 80s and 90s, and the sales figures back up that impression. Yamaha’s R7, for instance, despite not being in the first flush of youth, racked up 460 new registrations in the first nine months of 2023, with Honda’s age-old CBR650R coming in at 329 sales. Even Aprilia’s RS660 – a more expensive proposition than the Japanese machines – has been doing strong business, racking up 239 registrations in the same time period to easily become Aprilia’s best-selling motorcycle model in the UK.

It’s the brightest outlook for the sports bike market in years, suggesting a new generation of riders are discovering the joys of race-replicas and increasing the odds that more models will be launched into the same segment soon.

Top 10 best sellers (to the end of Q3, 2023)

|

Make

|

Model

|

Registrations

|

|

Yamaha

|

GPD125-A NMAX 125 ABS

|

2682

|

|

Honda

|

WW 125 A-P

|

2570

|

|

BMW

|

R 1250 GS Adventure TE

|

1486

|

|

Honda

|

CBF 125 M-M

|

1475

|

|

BMW

|

R 1250 GS TE

|

1145

|

|

Honda

|

CB 750 A-P

|

896

|

|

Royal Enfield

|

HNTR 350 E5

|

873

|

|

Triumph

|

Street Triple RS

|

798

|

|

Kawasaki

|

Ninja 1000SX

|

791

|

|

Royal Enfield

|

Super Meteor 650

|

783

|

Top 10 best sellers over 125cc (to the end of Q3, 2023)

|

Make

|

Model

|

Registrations

|

|

BMW

|

R 1250 GS Adventure TE

|

1486

|

|

BMW

|

R 1250 GS TE

|

1145

|

|

Honda

|

CB 750 A-P

|

896

|

|

Royal Enfield

|

HNTR 350 E5

|

873

|

|

Triumph

|

Street Triple RS

|

798

|

|

Kawasaki

|

Ninja 1000SX

|

791

|

|

Royal Enfield

|

Super Meteor 650

|

783

|

|

Royal Enfield

|

Classic 350 E5

|

674

|

|

Triumph

|

Trident

|

657

|

|

BSA

|

Gold Star

|

600

|

BSA Gold Star is a surprise top-10 best seller – bucking the trend for decreasing sales of retro bikes

Have electric bikes tripped a breaker?

There’s a huge push towards electric motorcycles at the moment, whether in the form of R&D investment or Government policy, but the sales figures show that customers have yet to be convinced in any substantial numbers.

The total UK market for electric bikes nosedived by 37.8% in 2023, dropping from 6526 new registrations in 2022 to just 4062 last year. Of those, the vast majority were at the low end of the market, with 1762 falling into the sub 5hp moped category and 1956 in the 5hp-15hp 125cc-equivalent segment. Just 58 electric bikes over 47hp (35kW) were sold in 2023, exactly half the number of that category sold in 2022.

It all points to a lack of progress in a field that really should be seeing a breakneck pace of development and reconfirms that despite a lot of bold talk there’s still virtually nothing in the higher end EV motorcycle market from any of the established brands.

When it comes to specific model sales, again we need to look at the DfT’s statistics for the first nine months of 2023. They show that the best-selling electric bike, by some margin, was Sur-Ron’s Ultra Bee (238 registered), followed by the Light Bee from the same brand (211 sold). VMoto’s CPA and Maeving’s RM1 tie for third on 186 registrations each.

You have to trawl down the list some way before any of the more established brands make an appearance. Piaggio is the first legacy brand to appear, with the Piaggio One scooter (102 registrations in the first three quarters of 2023 when you include two versions of the bike), with BMW’s CE 04 in 11th place on 70 registrations. The top selling Japanese model is the Yamaha Neo’s (12th place, 54 registered by the end of Q3 2023).

The Government is imminently due to release its response to the 2022 consultation into ending sales of non-zero emissions motorcycles in the UK, which proposed an outright end on new combustion engine bike sales by 2035 and ending the sales of sub-125cc machines by 2030. The parlous state of the electric motorcycle market in the UK suggests those plans are in no position to go ahead without some significant changes.

Despite the downward trajectory in 2023 and the slow take-up form big manufacturers, in the longer term electric bikes are still likely to become increasingly important, particularly when the sketchy charging network in the UK is improved.

Top 10 best-selling electric bikes (to the end of Q3, 2023)

|

Make

|

Model

|

Registrations

|

|

Sur-Ron

|

Ultra Bee

|

238

|

|

Sur-Ron

|

Light Bee

|

211

|

|

Super Soco

|

CPx

|

186

|

|

Maeving

|

RM1

|

186

|

|

Super Soco

|

TC Max

|

114

|

|

Super Soco

|

Cux

|

109

|

|

Yadea

|

G5S

|

92

|

|

E-Max

|

VSA

|

86

|

|

Piaggio

|

Piaggio One

|

79

|

|

Talaria

|

Sting

|

72

|

Sur-Ron Ultra Bee tops a disappointing electric bike sales chart

Latest in the used bike market

While it’s relatively easy to analyse the market for new bikes in the UK, the world of second-hand sales is a murkier one without the same clear paper-trail to monitor it.

However, there are statistics that give some clues to what’s happening. The most up-to-date Government statistics relate to the full year of 2022, and while it’s impossible to break down precisely the makes, models and styles of bikes that are changing hands it’s clear that there’s a roaring trade in used bikes, far exceeding the sales of new machines.

In 2022, there were a total of 504,602 used bike sales, based on the number of changes of keeper recorded on registration documents. Of those, 325,061 bikes change hands once during the year, 62,421 went through two sets of owners, 12,450 were sold three times and 2990 had four different keepers during the 12-month period. Somehow, 1011 bikes managed to have more than four keepers – presumably those are absolute lemons that owners can’t wait to get shot of. Another 2,444,672 registered bikes didn’t change hands during the year.

While there’s no breakdown of the makes and models that constitute all those sales, they’ll logically be in proportion to the overall numbers of specific models the road at the moment. Those are figures we can get hold of, and as with the Government’s new registration numbers the most recent figures relate to the number of bikes that were taxed in third quarter of 2023 – essentially the peak of last year’s riding season.

Those show that the single most common bike on Britian’s roads is Yamaha’s NMax 125 scooter, accounting for 13,516 taxed, road-legal machines at that snapshot in time. Stepping up to larger bikes, the BMW GS unsurprisingly dominates, with the R1200GS just pipping the R1250GS Adventure, followed by the standard R1250GS. Yamaha’s MT-07 is the next most popular bike over 125cc, followed by Triumph’s Street Triple RS and, surprisingly, the Yamaha FSZ600 and XJR1300, showing that those machines are managing to remain on the road many years after they were discontinued.

Another set of figures shows the bikes with a valid SORN (statutory off-road notice), suggesting they’re slumbering and waiting for their owners to revive them. The SORN’d bikes list is dominated by sports bikes of yore, with Yamaha’s R1 and R6 and Honda’s VFR800, CBR900RR and Blackbird all featuring in the top 20. Surprisingly, there are no BMWs, Suzukis, Triumphs or Kawasakis in the SORN top 20 at all. Perhaps their riders prefer to keep them taxed and road-legal.

Top 10 most common bikes (taxed at the end of Q3 2023)

|

Make

|

Model

|

Number licenced

|

|

Yamaha

|

NMAX 125 ABS

|

13,516

|

|

Honda

|

PCX 125 A-M

|

6103

|

|

Yamaha

|

YBR 125

|

5860

|

|

BMW

|

R 1200 GS

|

5439

|

|

Honda

|

CBF 125 M-M

|

5243

|

|

BMW

|

R 1250 GS Adventure TE

|

5033

|

|

Honda

|

PSX 125-A

|

4969

|

|

BMW

|

R 1250 GS TE

|

4385

|

|

Yamaha

|

MT-07 ABS

|

4316

|

|

Triumph

|

Street Triple RS

|

4181

|

Top 10 most commonly SORNed bikes (at the end of Q3 2023)

|

Make

|

Model

|

Number SORNed

|

|

Yamaha

|

YBR 125

|

6019

|

|

Yamaha

|

YZF-R1

|

5989

|

|

Honda

|

CBR 600 F

|

4841

|

|

Yamaha

|

FZS 600 Fazer

|

4593

|

|

Peugeot

|

Speedfight

|

4376

|

|

Yamaha

|

R6

|

4105

|

|

Piaggio

|

ZIP

|

3954

|

|

Piaggio

|

Vespa PX 125

|

3710

|

|

Honda

|

C90

|

3695

|

|

Piaggio

|

Vespa ET4

|

3480

|

Despite its near £40k price, the Ducati Panigale V4 R has sold strongly

Buying a motorcycle in 2024

You probably don’t need us to tell you that the heady days of 0% finance and tiny PCP payments are a faint memory now – with the Bank of England base rate at its highest since before the 2008 financial crisis (5.25% at the time of writing) and little chance that it will be dipping back to the sub-1% levels that we’ve got used to over the last decade or so.

A quick scan of the offers from major manufacturers at the moment shows their own finance schemes are largely hovering around the 9.9% mark at the time of writing, but as ever the really important number is the monthly payment, and that can vary wildly from one model to another because the bike’s depreciation affects its guaranteed future value (GFV), the final ‘balloon’ payment of a PCP deal. If, like many riders, you plan to chop in for another new bike rather than pay that final lump sum, choosing a machine that depreciates less – even if the interest rate or RRP is higher than another model – can result in a lower monthly outlay.

When it comes to particular deals at the moment, Honda has 9.9% APR representative PCP and various offers of free services, roadside assistance, tracker subscriptions, accessories contributions and deposit contributions on a selection of models across its range, and it’s a similar story at Yamaha. Suzuki and Kawasaki are both offering a lower rate of 4.9% on certain models (that’s below the BoE base rate) but also adopt the 9.9% level on others, and again have a wide array of money-off on accessories or deposit contributions.

The big European brands are in the same boat, with Ducati also offering 9.9% APR representative PCP on most of its models, along with bike-specific deals for money off accessories, while BMW has an 8.9% APR offer until April on a wide range of its bikes, along with deposit contributions on many of them, ranging as high as £1800. Triumph has ‘personalisation contributions’ – which can be used as deposits or spent on accessories or kit – on several of its remaining 2023 models, ranging as high as £2750 on the 2023-spec Tiger 1200.

However, don’t bank purely on the offers that manufacturers have on the table. Hunt for the specific bike you’re after and try a range of different dealers to see what each of them can come up with. There’s a good chance you’ll save hundreds, even thousands, compared to the RRPs on many bikes.

Motorcycling injuries haven’t been falling as fast under the current licence regime as they did before it was introduced. Brexit means there’s a chance to introduce a UK-specific system that works better.

What is in store for motorcycling in 2024?

With a General Election all but certain before the end of 2024 and polls pointing towards a change in government when it happens, time is running out for legislation changes that will impact motorcycling and a lot of big decisions are likely to be pushed back until after the vote.

However, there are several motorcycle-related things on the agenda at the moment that could have an impact on motorcycling as we know it.

The two biggest long-term changes that we can expect some clarification on relate to the future of motorcycle licences in this country, and the future of the internal combustion engine.

The Government’s consultation ‘L-category vehicles: ending sales of new non-zero emission models’ (‘L-category’ means motorcycles), closed in September 2022. In it, the Government proposed ending the sale of non-zero emissions bikes – essentially anything using a combustion engine – by 2035, with lower-performance bikes in the sub-125cc classes to be axed even sooner, in 2030. The consultation’s ‘what happens next’ section said that responses would be published within three months of the consultation closing, but that hasn’t happened and the official line is that the feedback is still being analysed.

The motorcycle industry has since met with Government representatives and is understood to be pushing for a more technology-agnostic approach, leaving doors open for ideas like hydrogen combustion engines and synthetic, carbon-neutral fuels for conventional petrol engines as well as pure electric bikes in the future.

A response from the Government is expected at some stage this year, but it seems increasingly unlikely that the cut-off dates mentioned in the original consultation (nearly two years ago now) can survive as manufacturers need to be given a reasonable lead-in time for such wholesale change in their technologies.

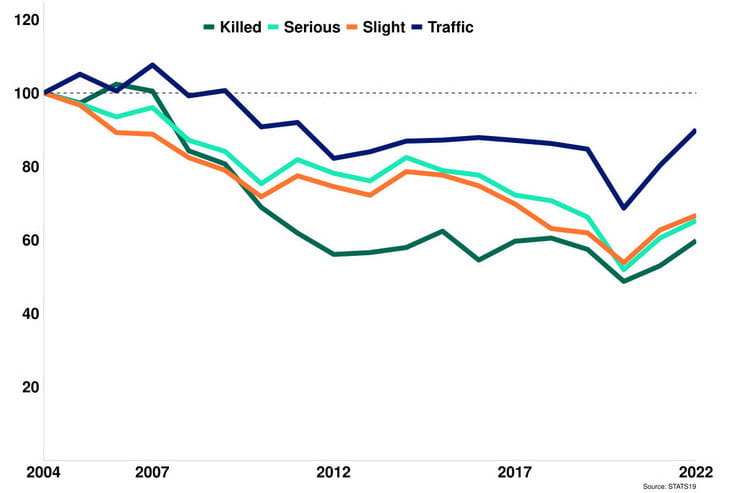

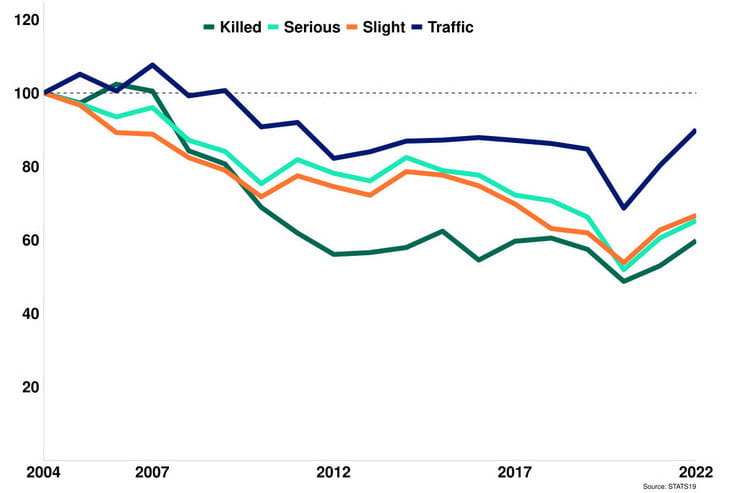

Where we might see beneficial legislative changes around motorcycling, and in a shorter-term future, is around the routes to motorcycle licences. The current, complicated and expensive system has been a bone of contention ever since it was introduced as part of the 3rd European Driving Licence Directive (3DLD) in 2013. It introduced hurdles and raised age limits for direct access, but far from resulting in a reduction in motorcycling deaths, the same time saw a consistent downward trend in fatalities come to an end. Between 2004 and 2012, the number of riders killed on the roads in this country annually dropped from 585 to 328, with a similar trend in injuries. But from 2013 to 2022 (the latest figures available), that decline has stopped. In 2013 there were 331 deaths, and in 2022 there were 350, with similar numbers in most years between. It’s a similar story for casualty rates per mile, which dropped from 186 riders killed per billion miles ridden in 2004 to 125 per billion miles in 2013 but have remained at that level ever since – the number for 2022 wad 123 per billion miles. One reason might be that riders are disincentivised from getting training and progressing up to the next licence stage, with many – particularly in today’s gig economy where scooters are a vital delivery tool – using CBT to get L-plates and then staying at that level rather than developing their skills to gain a full licence.

Brexit means the UK isn’t tied to the European Driving Licence Directive anymore. We’re free to implement our own system of training and testing, as well as different age limits if we want, and the motorcycle industry has been deep in discussion with the Government on how to do just that. In the EU the 4th European Driving Licence Directive is currently being finalised and isn’t expected to make it any easier to get on a bike, but the UK is in a position to adopt a more logical position that encourages riders to get more skills rather than simply adding more hoops to jump through.

We can look forward to more detailed proposals being laid out in the near future, but it will take legislation – and hence time – for real change to happen.

One Government consultation that has concluded this year relates to the MOT, which the DfT was considering changing to extend the gap before the first test from three years to four or even five. We dug into the details of that, and why it would be a bad idea, in 2023. With the conclusion of the consultation, the Government has decided not to change the MOT intervals, sticking with the age-old routine of three years before the first one, followed by annual tests, while vaguely suggesting that it will ‘explore’ modernising the MOT to better suit electric vehicles in the future.

The election hangs over all of this, of course. We’ve yet to hear what each party has planned for motorcycling, but be sure that once campaigning is underway, we’ll be pushing to get answers from each of them as to how they want to see it develop in the future.

If you’d like to chat about this article or anything else biking related, join us and thousands of other riders at the Bennetts BikeSocial Facebook page.